What is our Two-Phase SIP Calculator?

A Two-Phase SIP Calculator is a smart financial tool designed for Indian investors who want to estimate their wealth creation not just during their Systematic Investment Plan (SIP) years, but also during the growth (holding) phase after SIP ends.

Unlike a normal SIP calculator, this tool helps you understand how your investments continue to grow even when you stop contributing monthly.

Parallel Two-Phase SIP Investment Calculator

Compare both investment phases side by side

📈 SIP Phase

🌱 Growth Phase

How this calculator works?

Suppose you invest ₹10,000/month for 15 years at 12% p.a., then let it grow for another 10 years without investing further.

- Total Invested: ₹18,00,000

- Corpus After SIP Phase: ₹50,91,000 (approx.)

- Final Corpus After Growth Phase: ₹1.58 Crore (approx.)

This shows the power of compounding when you hold your SIP corpus longer.

How Does This SIP Calculator Work?

📌 Phase 1 – SIP (Accumulation Phase)

- You invest a fixed monthly amount (SIP).

- Investments grow at your chosen annual return rate (compounded monthly).

- At the end of the SIP duration, you get the Corpus After SIP Phase.

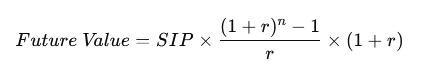

👉 Formula used:

- r = monthly return rate

- n = number of SIP months

📌 Phase 2 – Growth (Post-SIP Holding Phase)

- You stop SIP, but your accumulated corpus keeps growing.

- This creates the Corpus After Growth Phase.

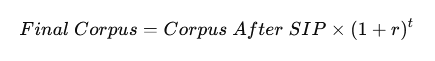

👉 Formula used:

t = number of months in the growth phase

Why Use our Next Gen SIP Calculator?

✅ Currency in Lakhs & Crores (Indian standard)

✅ Realistic caps: ₹25L SIP / 50 years / 30% max return

✅ Investor-friendly UI with inputs + pie chart visualization

✅ Accurate for retirement, child education, or wealth goals

Frequently Asked Questions (FAQ)

Q1. What is a Two-Phase SIP Calculator?

It’s a financial tool that calculates wealth from both the SIP investment years and the growth (holding) years after SIP stops.

Q2. How is it different from a normal SIP calculator?

A normal SIP calculator shows returns only during investment years. A Two-Phase SIP calculator also shows how your money grows after you stop SIP.

Q3. Who should use this calculator?

Investors planning for retirement, child’s education, or long-term wealth creation.

Q4. What is the maximum SIP I can calculate?

This calculator supports up to ₹25 Lakhs monthly SIP, 50 years duration, and 30% max annual return.

Q5. Does it calculate taxes?

No, it assumes compounding without deductions like tax or exit loads.

Q6. Can NRIs use it?

Yes, but results are displayed in Indian Rupees (₹).