Introduction

When you buy a new iPhone, you pay a premium — but how does that compare with investing in Apple shares? Many people ask: “Is it smarter to buy Apple stock or just buy iPhones whenever they release?” In this article, we explore the journey of iPhone pricing in India and the growth of Apple’s share price.

You will learn:

- What iPhone cost when first launched in India and how that compares with 2025 pricing.

- How Apple’s stock price has changed over the same period (in INR equivalent).

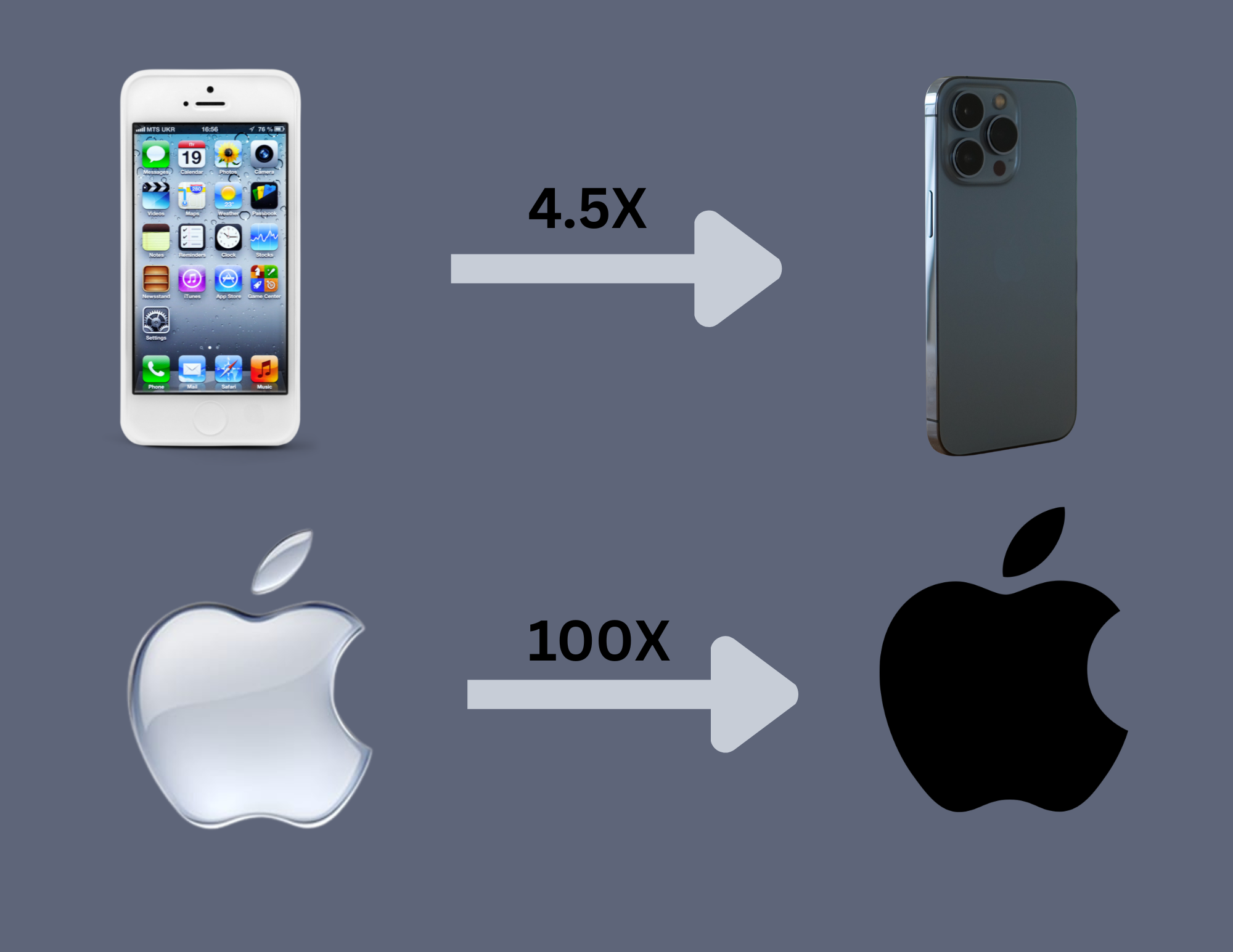

- A side-by-side comparison: how many times both have “grown.”

- What this means if you think of iPhone as a “status spend” vs shares as “investment.”

iPhone Price in India — Then vs Now

📱 Early iPhone Launch Price in India

- When Apple first sold iPhones in India (with the 3G model), the base variant (8 GB) reportedly launched at ₹ 31,000. The Indian Express+1

- That was around 2008 — roughly 17 years ago.

📈 What iPhone Costs Now (2025)

- Recent iPhone models (base / typical non-Pro models) in India cost roughly ₹ 80,000–₹ 1,40,000+ depending on model and storage. The Indian Express+1

- This means that compared to the original ₹ 31,000, today’s iPhone price is approximately 2.5 – 4.5 times higher (depending on the model).

iPhone Price Growth

| Period / Model | Approx. Launch Price in INR | Typical 2025 Price in INR | Growth Factor |

|---|---|---|---|

| 2008 (iPhone 3G) | ~ ₹ 31,000 The Indian Express | ₹ 80,000 (entry-level newer model) | ~ 2.6× |

| Base → Premium Model (over years) | ₹ 31,000 | ₹ 1,40,000+ (top models) | ~ 4.5× |

Over ~17 years, the cost of an iPhone in India has gone up significantly — partly due to inflation, upgraded technology, localization, tax/duties, and changing models.

Apple Stock Price Growth — Then vs Now

Apple Inc (AAPL)

📈 Where Apple Share Price Stood Earlier

- The share price of Apple (AAPL) has had fluctuations over years, but as per historical data: in 2008 (adjusted for splits), the closing price was around USD ≈ 2.56 (split-adjusted) Macrotrends+1

- By 2025, the share price is around USD ≈ 277. Macrotrends+1

💱 Converting Apple Stock Price to INR (2025)

- As of November 2025, 1 USD ≈ ₹ 88.70 (range ~ ₹88–89) Exchange Rates UK+1

- So, current Apple share price in INR = 277 × 88.70 ≈ ₹ 24,575 (per share).

📉 What That Means Compared to 2008

- In 2008: ~ USD 2.56 → in INR back then (less precise exchange data) but adjusted-price baseline.

- Growth from ~$2.56 to $277 = ~ 108× increase in USD terms (pre-splits adjusted).

- In INR terms, today each share is worth ~ ₹ 24,575.

Because Apple shares benefit from share splits, dividend reinvestments (if any), and global business growth — the rise is substantial.

iPhone vs Apple Shares — What Grown More (in Value)?

| Asset | Growth Factor (≈) | Comments |

|---|---|---|

| iPhone (India price) | 2.5 to 4.5× | Price rise due to product evolution, inflation, cost, duties. |

| Apple Shares | 100 to 110× (in USD) | Real value growth — reflects business growth, not just inflation or premium. |

Apple shares have grown far more than the iPhone’s price inflation. If you had invested money instead of buying successive iPhones, your capital could have grown much more.

What This Means for Consumers & Investors

✅ Buying iPhone — Pros & Cons

Pros

- You get a high-end smartphone with latest tech immediately.

- Good for lifestyle, social signalling — tangible “useful” product.

Cons

- High cost escalation over time — you essentially “pay for status + tech + premium.”

- No financial return — depreciation begins once you buy (unless you resell).

✅ Investing in Apple Shares — Pros & Cons

Pros

- Long-term capital growth (as shown by 100×+ rise in share price over years).

- Wealth creation — if held long-term.

Cons

- Market risk: share price fluctuates.

- Needs patience — long-term horizon (5–10+ years) to benefit fully.

- Currency risk for INR investors (USD to INR conversion matters).

Balanced Perspective: What Should You Do?

- If you want a smartphone now — buy iPhone. Accept that price is for utility and status, not investment growth.

- If you’re focused on wealth creation, consider investing in shares rather than repeatedly buying high-priced electronics.

- For many Indians: a balanced approach makes sense — use a good phone (doesn’t have to be the newest iPhone) and invest spare savings wisely.

- Always consider currency risk when investing in foreign shares (USD → INR fluctuations).

Disclaimer: This article provides general information only. It is not financial advice. Please consult a certified financial advisor before making investment decisions, especially in foreign stocks.

Conclusion

When we compare “iPhone vs Apple Shares”, the numbers tell a clear story: while iPhone price (in India) has increased 2–4 times over about 2 decades, Apple shares have grown more than 100 times (in USD terms).

Buying iPhones gives you instant gratification — a device for daily use. But investing in Apple shares could have built substantial wealth over time.

If you ask me — for long-term financial growth, shares win. For immediate utility or lifestyle, iPhone wins. As always: balance is key.

Use our SIP calculator to find out how your small monthly investments can grow into big returns over time.